Why Rate Parity Still Matters in 2025

- Anu Metsallik

- Jul 23, 2025

- 5 min read

Updated: Aug 22, 2025

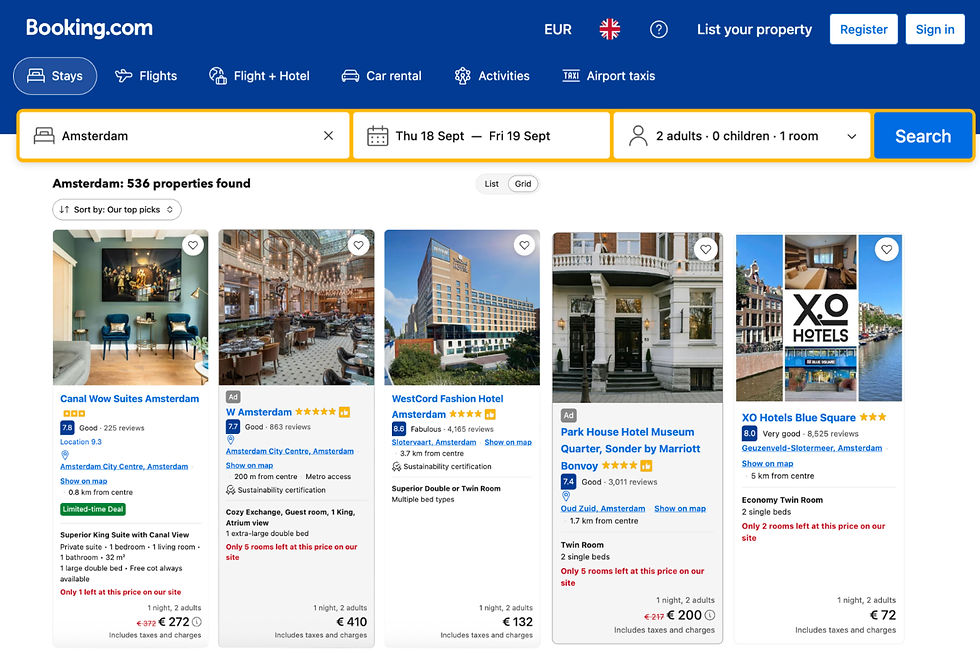

One of the longest-standing challenges for hoteliers has been striking the right balance between the visibility OTAs provide and the need to drive more direct bookings to avoid high commission costs.

The idea of undercutting Booking.com or Expedia by offering a slightly lower rate on your own website seems like a clever move — but in practice, it’s a risky tactic that can quietly backfire. OTAs monitor rate discrepancies closely and often respond with penalties and/or reduced visibility, which can sharply impact your booking volume.

You probably know that there’s been a major shift in the landscape and as of September 2024, hoteliers across the EU and EEA are no longer contractually bound by OTA rate parity clauses. That legal freedom is a win — but it comes with a catch: OTAs still reward price parity in their ranking algorithms, because it directly supports their competitive positioning. The law may no longer require parity, but their business model still does.

In 2025 a better approach would be focusing on strategic distribution: adding meaningful value to direct bookings, upgrading the online guest journey, and optimizing every touchpoint they control — all without jeopardizing their OTA presence.

This article breaks down how OTA algorithms shape visibility, why price parity still matters operationally, and 10 smart, actionable ways to grow your direct revenue — without getting caught in a pricing war.

What Is Rate Parity and Why It Matters

Rate parity means maintaining the same publicly available room rates across all online distribution channels—your website, OTAs, metasearch platforms, etc.

For hotels, rate parity helps prevent third-party undercutting, protecting both revenue and brand integrity. For consumers, it offers reassurance and simplicity—they know they’re getting the best rate no matter where they book. For OTAs, parity safeguards their business model by ensuring competitive pricing and discouraging hotels from using their platforms for exposure while offering better deals elsewhere.

New EU Ruling Ends Booking's Price Parity Clauses

As of July 1, 2024, the European Court of Justice has confirmed that, in compliance with the EU’s Digital Markets Act (DMA), Booking.com has eliminated all rate-parity obligations for properties within the European Economic Area (EEA).

This includes:

Narrow parity: requiring hotels to offer the same or lower rate on their own websites

Wide parity: requiring the same or lower rate across all other online distribution channels

Under the DMA, Booking.com has been formally designated as a “gatekeeper” — a dominant platform that must comply with stricter competition rules designed to curb anti-competitive behavior. The ruling applies to all accommodations in the EEA, even if they use non-European OTAs or channel managers.

If your property is located outside the EEA — including Switzerland, the United Kingdom, or the United States — parity clauses in your OTA contracts may still be active and enforceable. Booking.com has not committed to dropping parity requirements globally, so contractual obligations likely still apply in these markets unless the hotel negotiates their removal.

Booking’s Algorithmic Persuasion Still Rewards Parity

While legal obligations are gone for EEA hotels, Booking.com’s internal systems continue to encourage rate parity through a set of visibility levers that collectively form what industry observers call an "Algorithmic Persuasion Strategy":

Reward-Based Visibility

Hotels that maintain rate parity — especially with Booking.com — are rewarded with better ranking and exposure in search results.

Voluntary Parity = Better Performance

Price parity is no longer mandatory, but Booking promotes the idea that it leads to improved conversion and visibility — incentivizing hotels to keep their OTA rates competitive.

Subtle Visibility Reduction

Instead of explicitly penalizing hotels that break parity, Booking quietly reduces their visibility through: lower rankings in search results, removal from high-converting filters or deal categories and fewer featured placements or upsell modules.

Booking.com’s continued reliance on parity incentives is partly aimed at countering the “billboard effect” — a well-known guest behavior pattern where guests discover a hotel on Booking.com, benefiting from its tech, filters, reviews, and visibility; and then navigate to the hotel’s own website to book directly, bypassing commission fees.

To mitigate this, Booking uses both algorithmic ranking systems and subtle behavioural nudges to encourage hotels to maintain parity and discourage off-platform bookings that originate from Booking’s discovery tools.

How OTAs Discover Rate Parity Violations

Booking.com, Expedia, and other OTAs deploy automated bots, also known as web crawlers, to routinely scan the internet, including hotel websites and metasearch engines.

These bots:

Mimic real user behavior (checking availability, running searches by date/location).

Monitor public prices on your official site and compare them to those listed on their own.

Record even small undercuts (as little as €1–2), triggering an alert in their system.

Employ manual testers or AI-simulated users to Monitor geo-targeted undercutting (better rates shown only to certain countries) and detect session-specific discounts (if a coupon is revealed on exit intent).

What Happens When You Violate Rate Parity?

When you're contractually obligated to maintain rate parity — as is still the case in markets like the UK, Switzerland, or the U.S. — and an OTA detects a breach, consequences are typically swift and silent:

❌ Lower OTA search rankings: Your property appears lower in OTA results, dramatically reducing visibility and click-through rates.

❌ Loss of promotional placement: You may be excluded from high-performing filters such as Top Picks, Deals, or Recommended.

❌ Increased commissions: Some OTAs penalize disparity by automatically moving you into higher commission brackets.

❌ Exclusion from Preferred or Genius Programs: You may lose status and perks (like access to Genius travelers) if you consistently break parity.

❌ Rate suppression: OTAs may suppress your rate for specific dates or even automatically match your lower direct rate—then bill you the difference.

Margin Shaving or Commission Rebating

Even when you're playing fair, OTAs may display lower prices than your website by cutting their own commission—a tactic known as margin shaving. When they want to stay competitive or promote themselves as offering the “lowest price,” they may cut into their own margin (commission) to display a lower rate than what you’ve provided.

So when you list a room at €150 and OTA has a 20% commission agreement and typically earns €30, to win the guest, the OTA lists the room at €145 and takes only €25 in commission.

OTAs do this to win the booking as users tend to book the lowest visible rate, to outperform metasearch: On Google, Trivago, etc., lower rates often rank higher and steal the conversion from competitors, especially when multiple OTAs are bidding for the same property.

This tactic is typically applied to strategic partners (hotels with high volume or popularity), on mobile-only rates, in highly competitive markets or compressed dates or as part of closed user group promos (like logged-in Genius users).

What to do in these cases?

Ask your OTA account manager if your property is part of any rate-shaving programs.

Opt out of OTA-funded discounts or promotions, such as Booking.com's Genius Level 2/3, mobile discounts, or price-match schemes.

Track OTA-displayed rates via tools like RateGain, OTA Insight, or even manual audits.

Use a price-match widget on your direct site: “Found a lower price elsewhere? We’ll match it + give you free breakfast.”

How to Win: Don’t Undercut, Differentiate

Want to boost your hotel’s direct bookings in 2025? From exclusive website offers and loyalty perks to influencer marketing, SEO upgrades, and booking engine improvements—small changes can drive big results.

We’ve rounded up 15 proven strategies to reduce OTA dependency and grow your revenue through direct bookings here:

Key Takeaways

Maintaining rate parity doesn’t mean you’re stuck. It means you have to get smarter, not cheaper. Guests don’t just book based on price—they book based on perceived value, trust, and experience.

If you differentiate your direct channel with better perks, content, and convenience, you’ll win in 2025—not just in bookings, but in brand loyalty and revenue.